Make Defensible Go/No‑Go Decisions Before Design or Capital Commitment

Feasibility, funding alignment, and development strategy before design and procurement

UPL1FT Consulting Inc. helps municipalities, developers, and public interest organizations make defensible decisions before design, procurement, or capital commitment.

Engage UPL1FT

Where Projects Quietly Fail

Scope is implied instead of validated

Feasibility is confused with early design

Cost certainty is pursued without decision certainty

Funding is treated as an afterthought

Governance and phasing are addressed too late

By the time these issues surface, they are expensive to correct and politically difficult to reverse.

What UPL1FT Does

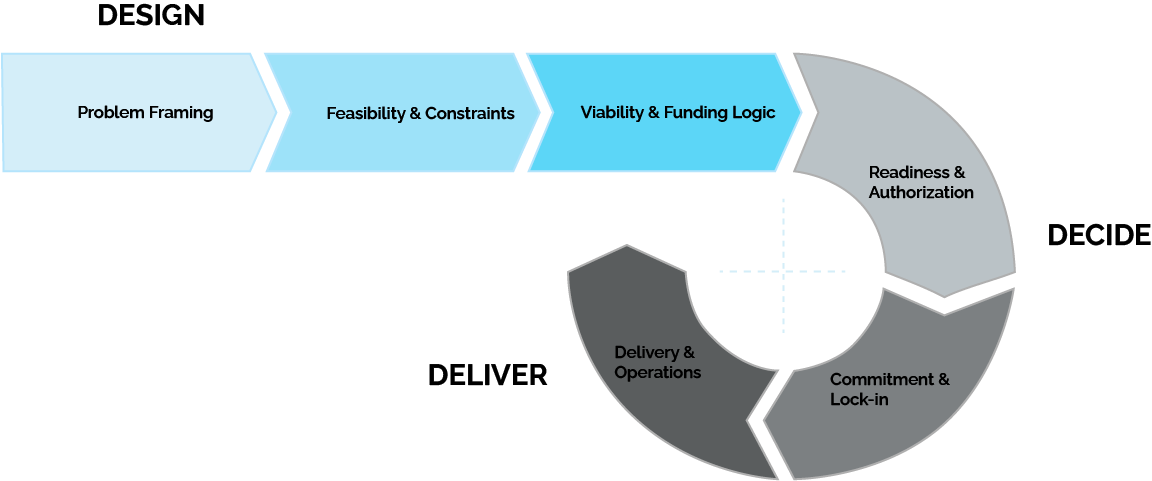

UPL1FT operates at the front end of complex development decisions.

We help clients determine what to build, where, at what scale, and with what delivery and funding logic, before those decisions become locked into design and procurement.

We do not design buildings or manage construction.

We make sure the right project is being pursued before those services are engaged.

Decisions That Define the Path Forward

These are the inflection points that determine project viability and capital exposure.

UPL1FT addresses them in structured sequence.

-

Determines whether a project should proceed and under what constraints.

Feasibility is often treated as preliminary design rather than a decision filter. Critical assumptions about land use, servicing, cost, and political viability remain untested until later stages.

UPL1FT approaches feasibility by:

Testing real constraints early

Validating assumptions against policy, data, and market conditions

Defining decision thresholds before design begins

The outcome is clear viability, defined conditions for advancement, and early identification of what must change.

-

Determines whether a project is economically viable and how it can be capitalized.

Market and financial analysis often breaks down when demand, cost, and funding assumptions are treated separately. Projects advance without clarity on capital sources, financial thresholds, or funding eligibility.

UPL1FT focuses this work on:

Testing demand against real market behavior

Identifying capital sources and funding pathways early

Defining financial thresholds required for grants, debt, or private investment

Aligning project structure with funding criteria

Stress testing scenarios for escalation, absorption, and delivery risk

The result is a clear, fundable business case defining viability, constraints, and required adjustments before commitments are made.

-

Determines whether a viable project is positioned to secure funding and advance.

Projects often stall at this stage not due to weak fundamentals, but because governance and authorization structures are misaligned. Unclear decision rights, contract misalignment, or poorly sequenced approvals prevent capital from moving even when funding is available.

UPL1FT focuses this work on:

Assessing authorization capacity and required approvals

Identifying decision points necessary to unlock funding

Aligning contract structures with procurement and delivery models

Establishing fit for purpose working groups and decision pathways

Sequencing governance to protect funding opportunities

The result is institutional readiness, defined authority, and a clear path to capital.

-

Determines whether a project remains functional, fundable, and defensible over time.

Climate risk is often treated as compliance rather than an operational and funding issue. When hazards such as heat, flood, smoke, seismic events, or service disruption are not addressed early, they surface later as continuity failures, insurance constraints, unfunded retrofits, or lost funding eligibility.

UPL1FT focuses this work on:

Identifying material climate and hazard risks

Assessing service and operational continuity exposure

Distinguishing required resilience measures from discretionary upgrades

Aligning resilience decisions with funding eligibility

Ensuring responses are realistic, affordable, and defensible

The result is a project positioned to maintain continuity under future conditions while accessing resilience-related funding without unnecessary cost.

-

Determines where limited capital should be directed first and what can be deferred without creating future risk.

Upgrade decisions break down when projects are evaluated in isolation or ranked through oversimplified scoring. Safety, operational impact, funding eligibility, timing, and long term consequences must be assessed together.

UPL1FT focuses this work on:

Identifying upgrades that materially reduce risk or unlock future options

Distinguishing urgent requirements from strategic opportunities

Aligning priorities with funding windows, lifecycle timing, and delivery capacity

Testing tradeoffs across safety, service continuity, cost, and long term viability

Sequencing actions to preserve future flexibility

The result is a defensible prioritization framework defining what proceeds now, what is staged, and what is deferred.

-

Determines whether analysis translates into executable decisions within real world governance structures.

Projects stall when sequencing is misaligned with approval thresholds, decision authority, or organizational capacity. Feasible initiatives lose momentum when procurement is triggered prematurely or phased incorrectly.

UPL1FT focuses this work on:

Clarifying decision authority and approval thresholds

Structuring phased pathways that preserve optionality and reduce risk

Aligning funding and procurement timing with governance realities

Identifying where decisions should advance, pause, or remain conditional

Matching delivery strategy to organizational capacity

The result is a defined path from decision to delivery that preserves credibility and avoids premature commitment.

Selected Work

White Rock Community Hub (HUBWRX)

Council-facing feasibility and site evaluation to support long-term civic renewal. Scope, scale, phasing, funding readiness, and procurement alignment completed prior to downstream consultant engagement.

Development Incentives Policy Review

Policy and market aligned development incentives framework to catalyze private investment and guide municipal decision making. Financial and regulatory tools were tested against real project economics to ensure incentives were credible, defensible, and implementable.

Stoney Kananaskis Land Project (SKLD)

Indigenous led land development feasibility and infrastructure validation to support long term economic self determination. Development scenarios, servicing capacity, energy systems, and financial models were integrated to inform staged decision making prior to capital commitment.

Who We Work With

UPL1FT works with clients who understand that the most consequential development decisions happen early.

Our engagements typically involve organizations navigating complexity, public accountability, capital risk, and long-term operational responsibility.

We are most effective when clarity is valued over speed and when early decisions are treated as strategic acts, not administrative steps.